- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- NT2015.003, EC87/15, ICMS Partition, Poverty Fund

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Configuring the system to NT2015.003, EC87/15, ICMS Partition, Poverty Fund

This post is a complement to the post:

Constitutional Amendment 87/2015

If any of the subjects below come to your path, you may find this post helpful. This is only required for companies in Brazil, so if your company has business places in Brazil, you may need to configure:

ICMS Partition, Poverty Fund, EC87/15 and NT2015.003 changes…

Those changes impacts multiple areas (MM, SD, FI)

If you search online, you are going to see here similar SAP Official documentation released by the localization team. But many of those documents are in Portuguese discussion forums. They did a very good job to such complicate subject but without their guidance, implementing it would have been much more painful.

Since I did use SAP Localization Team documentation and the several discussions on SCN as source of information to build this solution, you may end seen here things that you already saw.

I want to share my personal experience with this subject and also provide some screenshots to help you if this subject crosses your path anytime in the future. This post will focus on TAXBRA/RVABRA (if you are still running TAXBRJ/RVXBRA, consider migrating it soon)

I will skip the business requirement, the law and why those changes are required as this was already discussed on my previous post:

Constitutional Amendment 87/2015

Where did I start the hands-on in the system to make it work?

1 – SAP KBA note: 2259931 - FAQ of EC87 and NT003 solutions

2 – Webinar Presentation (Portuguese): https://sap.na.pgiconnect.com/p5d77g2hgfm/

3 – Main OSS Note: 2232757 - Interstate consumption operations for ICMS non-taxpayer

4 – SCN SPED & NFE Forum (Portuguese)

What to do then?

My recommendation was implement ALL OSS Notes listed in the KBA Note above when relevant to the SAP Release and also to update the NFe environment to the SP23.

Depending on the release and support package you are running, you may have to implement less than 20 OSS Notes or more than 150 OSS Notes… So, be prepared with Basis/ABAP resource for that. And many of those OSS Notes have several Manual Pre and Post implementation steps.

Make sure to keep track on any configuration step mentioned in the OSS Note, either as an attachment or in the OSS Note Solution details. Once those OSS notes are implemented, the configuration steps should not take that long… few hours (or few days depending the number of pricings you have and how complex they are, you may need to adjust, move and reconfigure the pricing steps to open space to the new entries).

After updating the NFe environment to the SP23, check any OSS Note released that were not added to the SP23 and implement them too. If you want narrow the number of OSS Notes for this application area, check the descriptions if it mention things like:

- NT 003/2015

- ICMS Partition

- Note 2015.003

Configuration

To help speed-up the configuration and harmonize the creation of several new tax related elements, SAP provided BCSets (according to you tax procedure: TAXBRA/RVABRA or TAXBRJ/RVXBRA). Those BCSets are in the attachment’s session of OSS Note 2232757.

Items created via BCSet:

- INTERNAL CODES FOR TAX CONDITION

- J1BTAX > Condition Setup > Condition Mapping > Internal Codes

- ICMSBASE_INTRA ICMS: Intrastate Base

- ICMSNONCONTRIBUTOR: ICMS Non Contributor

- ICMSSPECFUNDBASE ICMS: Special Fund Base

- ICMSSPECFUNDRATE ICMS: Special Fund Rate

- NF_ICMS_PART_INTER_ACTIVE: ICMS Origin Partition Active

- NF_ICMS_PART_INTER_AMOUNT: ICMS Origin Partition Amount

- NF_ICMS_PART_INTER_BASE ICMS: Origin Partition Base

- NF_ICMS_PART_INTER_RATE ICMS: Origin Partition Rate

- NF_ICMS_PART_INTRA_ACTIVE: ICMS Destination Partition Active

- NF_ICMS_PART_INTRA_AMOUNT: ICMS Destination Partition Amount

- NF_ICMS_PART_INTRA_BASE: ICMS Destination Partition Base

- NF_ICMS_PART_INTRA_RATE: ICMS Destination Partition Rate

- NF_ICMS_SPEC_FUND_AMOUNT: ICMS Special Fund Amount

- NF_ICMS_SPEC_FUND_BASE: ICMS Special Fund Base

- NF_ICMS_SPEC_FUND_RATE: ICMS Special Fund Rate

- CONDITION TYPES FOR SD

- J1BTAX > Condition Setup > Condition Types > Condition Types SD

- BX90: ICMS Orig Part Base

- BX91: ICMS Dest Part Base

- BX92: ICMS Orig Part Rate

- BX93: ICMS Dest PartRate

- BX94: ICMS Orig Part Amt

- BX95: ICMS Dest Part Amt

- BX96: ICMS Spec Fund Amt

- BX97: ICMS Spec Fund Rate

- BX98: ICMS Spec Fund Base

- BX9D: ICMS Part Dest Off

- BX9O: ICMS Part Orig Off

- BX9P: ICMS Spec Fund Off

- DINC: ICMS Non Contributor

- ICAO: ICMS Destin offset

- ICAP: ICMS Destin Part

- ICEO: ICMS Origin offset

- ICEP: ICMS Origin Part

- ICPO: ICMS SP offset

- ICSP: ICMS Special Fund

- ISFB: ICMS Spec Fund Base

- ISFR: ICMS Spec Fund Rate

- ISIB: ICMS Intrastate Base

- CREATION OF CONDITION TYPES FOR MM

- J1BTAX > Condition Setup > Condition Types > Condition Types MM

- BICJ: ICMS Spec Fund Rate

- BICK: ICMS Spec Fund Base

- BICL: ICMS Intrastate Base

- BX90: ICMS Orig Part Base

- BX91: ICMS Dest Part Base

- BX92: ICMS Orig Part Rate

- BX93: ICMS Dest Part Rate

- BX94: ICMS Orig Part Amt

- BX95: ICMS Dest Part Amt

- BX96: ICMS Spec Fund Amt

- BX97: ICMS Spec Fund Rate

- BX98: ICMS Spec Fund Base

- DINC: ICMS Non Contributor

- ICAP: ICMS Dest Partition

- ICEP: ICMS Orig Partition

- ICSP: ICMS Special Fund

- MAPPING INTERNAL CODES FOR TAX CONDITIONS TO CONDITION TYPES

- Assign Condition Types to Internal Codes for Tax Conditions - SD:

- ICMSBASE_INTRA - ISIB

- ICMSNONCONTRIBUTOR - DINC

- ICMSSPECFUNDBASE - ISFB

- ICMSSPECFUNDRATE - ISFR

- NF_ICMS_PART_INTER_AMOUNT - BX94

- NF_ICMS_PART_INTER_BASE - BX90

- NF_ICMS_PART_INTER_RATE - BX92

- NF_ICMS_PART_INTRA_AMOUNT - BX95

- NF_ICMS_PART_INTRA_BASE - BX91

- NF_ICMS_PART_INTRA_RATE - BX93

- NF_ICMS_SPEC_FUND_AMOUNT - BX96

- NF_ICMS_SPEC_FUND_BASE - BX98

- NF_ICMS_SPEC_FUND_RATE - BX97

- Assign Condition Types to Internal Codes for Tax Conditions - MM:

- ICMSBASE_INTRA - BICL

- ICMSNONCONTRIBUTOR - DINC

- ICMSSPECFUNDBASE - BICK

- ICMSSPECFUNDRATE - BICJ

- NF_ICMS_PART_INTER_ACTIVE - ICEP

- NF_ICMS_PART_INTER_AMOUNT - BX94

- NF_ICMS_PART_INTER_BASE - BX90

- NF_ICMS_PART_INTER_RATE - BX92

- NF_ICMS_PART_INTRA_ACTIVE - ICAP

- NF_ICMS_PART_INTRA_AMOUNT - BX95

- NF_ICMS_PART_INTRA_BASE - BX91

- NF_ICMS_PART_INTRA_RATE - BX93

- NF_ICMS_SPEC_FUND_AMOUNT - BX96

- NF_ICMS_SPEC_FUND_BASE - BX98

- NF_ICMS_SPEC_FUND_RATE - BX97

- TAX TYPE

- J1BTAX > Condition Setup > Tax Type

- ICAP: ICMS Destination Partition

- ICEP: ICMS Origin Partition

- ICSP: ICMS Special Fund

- NOTA FISCAL MAPPING FOR SD

- J1BTAX > Condition Setup > Nota Fiscal Mapping > Tax Values SD

- NOTA FISCAL MAPPING FOR MM

- J1BTAX > Condition Setup > Nota Fiscal Mapping > Tax Values MM

- CREATION OF PROCESSING KEYS FOR FI

- OBCN

- MW6: Partition Origin;

- MW7: Partition Destination;

- MW8: Part.Spec.Funds;

- DEFINITION OF ACCOUNT KEYS FOR SD

- OB40

- OBCN

- J1BTAX > Condition Setup > Tax Type

- Assign Condition Types to Internal Codes for Tax Conditions - SD:

- J1BTAX > Condition Setup > Condition Types > Condition Types MM

- J1BTAX > Condition Setup > Condition Types > Condition Types SD

- J1BTAX > Condition Setup > Condition Mapping > Internal Codes

Configuration not delivered via BCSet

- Creation of Condition Formula for SD and MM

- Those formulas will be assigned to condition DINC on TAXBRA and RVABRA (or equivalents)

- VOFM > Formulas > Condition Value

FORM FRM_KONDI_WERT_980.

*{ INSERT 1

*Manual Instructions FOR SAP Note 2232757

*Technical Note 2015/003 - Interstate Consumption Operations FOR non ICMS-contributors

*Version 5

* STEP # 2- ormula_SD_605_higher* Determination of non ICMS-Contributor according to Technical Note 2015/003

* Created according to SAP Note 2232757

* Relevant for Sales and Distribution Customizing

* Relevant only for BrazilDATA:

lv_iedest TYPE j_1bnfe_iedest.CONSTANTS:

lc_no_icms_contributor TYPE j_1bnfe_iedest VALUE '9'.* Select the ICMS Taxpayer value according to Vendor'sSELECT SINGLE j_1biedest

FROM j_1bticmstaxpay

INTO lv_iedest

WHERE j_1bicmstaxpay = komk-icmstaxpay.* Check if ICMS Taxpayer refers to non ICMS-contributor

IF sy-subrc = 0 AND lv_iedest = lc_no_icms_contributor.

xkomv-kbetr = 100000.

ENDIF.*} INSERT

ENDFORM.

FORM FRM_KONDI_WERT_981.

*{ INSERT 1*Manual Instructions FOR SAP Note 2232757

*Technical Note 2015/003 - Interstate Consumption Operations FOR non ICMS-contributors

*Version 5

* step # 2- formula_MM_605_higher* Determination of non ICMS-Contributor according to Technical Note 2015/003

* Created according to SAP Note 2232757

* Relevant for Materials Management Customizing

* Relevant only for BrazilDATA:

lv_business_place TYPE j_1bbranc_,

lv_iedest TYPE j_1bnfe_iedest,

lv_icmstaxpay TYPE j_1bicmstaxpay.CONSTANTS:

lc_no_icms_contributor TYPE j_1bnfe_iedest VALUE '9'."Gets business place using plant

SELECT SINGLE j_1bbranch

INTO lv_business_place

FROM t001w

WHERE werks = komp-werks."Gets ICMS Taxpayer indicator from Business Place

SELECT SINGLE icmstaxpay

INTO lv_icmstaxpay

FROM j_1bbranch

WHERE bukrs = komk-bukrs

AND branch = lv_business_place.SELECT SINGLE j_1biedest

FROM j_1bticmstaxpay

INTO lv_iedest

WHERE j_1bicmstaxpay = lv_icmstaxpay.IF sy-subrc = 0 AND lv_iedest = lc_no_icms_contributor.

xkomv-kbetr = 100000.

ENDIF.*} INSERT

ENDFORM.

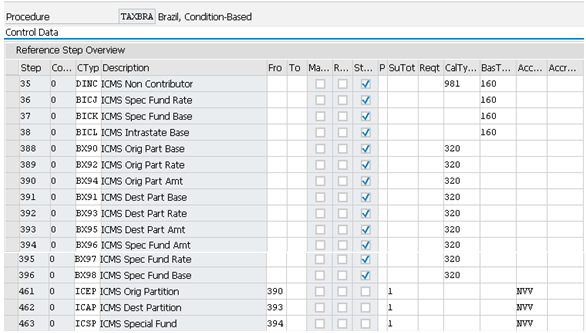

- Calculation Procedure SD

- Add the entries below to the SD pricing procedures:

- J1BTAX > Condition Setup > Calc. Procedures > Calc Procedures SD

* Use the number you created the formula in your system.The “Step” values described above may vary according to the Calculation Procedure existing entries. Those steps can be in different numbers but the order / sequence is relevant for correct calculation.

- Calculation Procedure MM

- J1BTAX > Condition Setup > Calc. Procedures > Calc Procedures MM

Added the entries below:

* Use the number you created the formula in your system

Update MM/FI Tax Codes

- J1BTAX > Tax Calculation > Tax Codes MM

The Tax Codes used for consumption purchase must be updated. Those are the Tax Codes where at J_1BTAXCODEV the Usage is “CONSUMPTION”Activate the Conditions ICEP, ICAP and ICSP (this can also be done via FV11/FV12).Example:

Define ICMS Partilha

The ICMS Partilha is the partition of ICMS tax due to difference between intrastate (state of destination) and interstate operations. In this case, this difference will be shared between the state of origin and the state of destination, according to Constitutional Amendment 87/2015 (Emenda Constitucional 87/2015) and ICMS Agreement 92/2015 (Convênio ICMS 92/2015), defined by the Brazilian Government.Define the percentage of ICMS Partilha, according to the state of destination, using the J_1BTPARTILHA view, informing the tax rate defined by the Brazilian government. You also need to define a valid initial date to start the tax

calculation.

SD Tax Conditions in Nota Fiscal Fields

J1BTAX > Condition Setup > Nota Fiscal Mapping > Tax Values SD

- Update in all SD Pricing Procedures the following

Maintain Tax SD Conditions Offset (VK11)

To the conditions BX9O, BX9P, BX9D, ICEO, ICAO and ICPO maintain the condition record via VK11

Maintain Tax Types

J1BTAX > Condition Setup > Tax Types

Maintain the entries below:

Calculation Procedure MM

SM30 > J_1BTICMSTAXPAY

It will be added the entries below:

Note that you can change 01, 02, 09 to anything you want, as longer as the IE Indicator 1, 2 and 9 are mapped and for the EC87 purpose, the customer/business place will have the entry assigned to 9 on their field ICMS Tax Payer.

Cutover Activities

MAINTAIN TAX SD CONDITIONS OFFSET

Select VK11 Transaction and add the following data for the Conditions BX9O, BX9P, BX9D, ICEO, ICAO and ICPO:

“Country”: BR;

“Amount”: 100,000-

“Unit”: %;

”Calculat. Type”: A

CREATION OF G/L ACCOUNTS AND ASSIGN TO TAX ACCOUNTS

Case needed, you may create the related to G/L Accounts assigning to the Account Keys created previously through OB40 Transaction;

OB40

- MW6 - ICMS Origin Partition

- MW7 - ICMS Destination Partition Expense

- MW8 - ICMS FCP Expense

Update MM/FI Tax Codes

Customer Master Records / Branch Data

To the Sales and Procurement Scenarios, it will be needed to identify if the customer or the branch involved in the process is ICMS non-contributor. To check this, the formulas in the procedure are used.

The formulas will use the information from ICMSTAXPAY (branch) and IEDEST (Customer).

“Fundo de Pobreza” Poverty fund Settings on J1BTAX

You should maintain the transaction J1BTAX the base and rate of poverty fund, being configurable based on UF region. SAP extended tables J_1BTXIC1, J_1BTXIC2 and J_1BTXIC3 to add 2 new fields. Remember that the program first reads exceptions for material, then the dynamic exceptions and only then the default setting only by region. The program will read the data from poverty fund from the target state configuration.

Note that the Poverty Fund Rate/Base should not be added to the Interstate rate entry, for example, if you are shipping from SP to RJ, you should have an entry from RJ to RJ and then add the Poverty Fund Rate/Base.

The Poverty Fund rate/base is always added to the Internal ICMS Rate, never to the interstate rate.

Another example, selling from another state to a customer, end-consumer in SP, the Ship From and Ship To will be SP / SP:

The Poverty Fund rate must be part of the Destiny Internal ICMS Rate. The system will do the calculation to find the rate without the Poverty Fund rate (19% - 1% = 18%).

I have an entry to this customer in my dynamic exception to calculate ICMS 12% in interstate ICMS rate. I will NEVER add the Poverty Fund Rate to the interstate entry.

Activate VOFM Formulas

SE38 > RV80HGEN

Customer Master Data

Review customer master data where end-consumers must have the ICMS Tax Payer Indicator 9 (No ICMS Contributor).

Business Place Master Data

If your branch is Non ICMS Contributor, then assign the ICMS Tax Payer 09. If not, your branch will not be affected by the calculation of Poverty Fund when buying goods for consumption.

With the configurations and following the steps above, it should be enough to get the system (Sales Orders and Purchase Orders) when relevant, calculating the ICMS Partilha and Poverty Fund.

On my next post I will show some examples of this postings in the system.

Leandro da Pia Nascimento

- SAP Managed Tags:

- FIN Controlling

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

| User | Count |

|---|---|

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 |